Dear Private Language Schools in the EU,

I am writing this because it has recently come to my attention that local and national newspapers (especially in the UK) are reporting on the financial situation in Europe very differently to financial newspapers and banks. Consequently I think many people are not unaware of the real financial situation in Europe or of a new rule from the EU, which could potentially cause some schools to go out of business.

[This article sums up the new rule and a lot of this blog post]

If you are reading this and believe this is all nonsense because you do read the newspapers let me use Tuesday 12th July as a good example. Leading up to this day a lot of financial newspapers and banks have warned the EU that it has a massive financial crisis on its hands and that its rules are hindering rather helping the banks in Italy. Then on Tuesday the IMF made their own official statement with the same warning. While on the same day the Eurozone’s financial ministers met and agreed that the rules introduced are fine and are a good idea. Merkel even said that she couldn’t see a financial crisis within the EU. [There have been several articles and blog posts joking about this – all really worth reading]

Strangely enough from what I have seen (with a couple of exceptions) the national papers seemed to have focussed on what the EU officials have said and not the banks or financial papers have said.

Of course I am sure most reading this by now are wondering how this has got anything to do with language schools in Europe. Well… I don’t know if you already know about this new law and if you have kept up with the news with the Italian banks and the financial situation across Europe. So this will be long but I need to explain the details for you to see the potential problem. It is speculation but there is so much pointing to this happening it is scary.

As of 1st January 2016 a new EU law was introduced that no bank will be able to ask for a bail out from either their country or from the EU without doing a ‘bail-in’ first. This means the banks can take money from any bank account which has more than €100,000 in it (it is supposed to be a loan but with a failing bank that never happens). The EU tested this in Cyprus back in 2013 before introducing it to EU law this year. The consequence was lots of people lost their pensions and small businesses went bust. In Cyprus most only got on average 47.5% of their money bank.

Now this of course €100,000 is a lot of money which very few people have and some schools won’t have enough. And it is only for nearly bankrupt banks. Thus at the moment it will only affect schools in Italy, Romania, Greece and schools with accounts in struggling banks. However it is the timing which is going to be crucial and I think will ruin a few schools.

Despite the EU sweeping it under the carpet there will be another Euro Crisis very soon.

Originally I thought this crash of the Euro would be in 6 months to a year but now I think it will be between October and December.

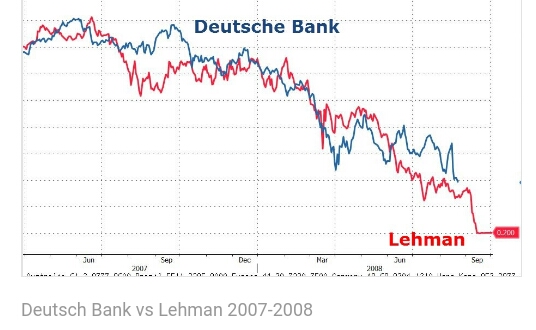

This is because it is literally a game of who will go bankrupt first: The Italian banks or the Deutsche Bank. Which ever does go first it will bring down the other with it along with the rest of Europe as they are so connected. Also the reason I predict October is because the Deutsche bank has been compared to Lehman Brothers in the US who in 2008 started the crash and led to the first Euro Crisis – Some even suggesting this could be far worse. If they continue to follow in their footsteps as they are doing now they will only last for about 2 to 6 months max!

(This is not to mention that it could be affected by all the political events of elections and referendums across Europe, including a referendum on the political structure in Italy,all set for the same month.)

(A graph comparing the Deutsche Bank to Lehman Brothers in 2008 to show the time frame – Taken from a recent article)

(A graph to show how close the Detsche Bank is to bankruptcy – Shares in 2009 were worth €139, now they are worth €13! Taken from a different article)

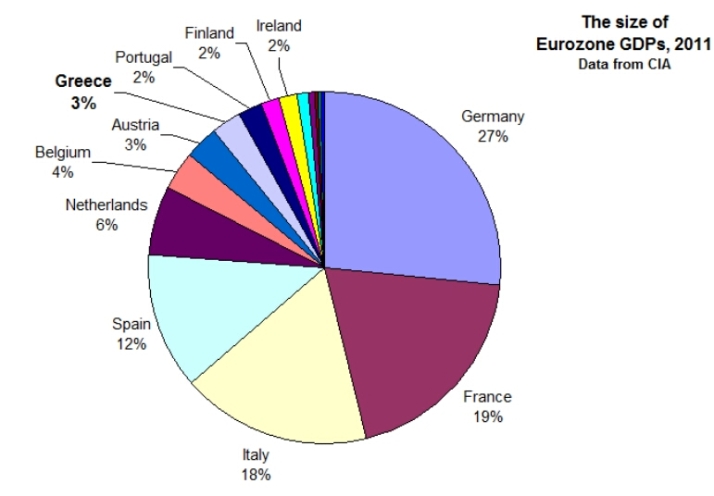

With the Deutsche Bank making up a massive part of the German economy plus with so many connections and the Italian economy being one of the biggest in Europe this crash will be about 5 times bigger than the crisis with Greece. And like last time it will hit every country in the Eurozone hard (as well affect the world). Consequently there will be a banking crisis across the continent.

[Interestingly even so the Deutsche Bank is also ignoring their situation trying to blame the Italian banks and give financial advice to everyone else]

(A graph to demonstrate how much more impact issues in Germany and Italy will be compared to Greece)

This is where the schools come in. I am sure many language schools in Europe work the same way where they collect the fees from students for the whole year over the summer and maybe even offer a discount to students who pay for the whole year before the school year starts as an incentive to do so. So if this hits in October a school like this would probably have well over €100,000 in their accounts (depending how big they are). To put it in perspective, if a year’s fees at a school is €1000 then it only needs 100 students to reach this cap. This money is used to cover materials, office rent, salaries, etc throughout the year.

Now, if you include a Euro Crisis in October/November and seeing how this will be such a big crisis it ups the chances all banks will suffer and any school with €100,000 it as a major risk.

If it follows what happened in Cyprus in 2013 any school over this threshold could lose 47.5% of all their money before December. Which means there will be not enough money to pay for teachers and resources, and if they aren’t able to pay teachers and lessons are cancelled, then students will demand that they get their money back which the school can’t afford either. This effectively means the school would be bankrupt.

The only way I can see is there are a couple of ways to get around this: Firstly it is to split the money into separate bank accounts at separate banks. This is because then the account won’t have over €100,000 in it. Or secondly as someone else has suggested, take some of the money out and convert it into dollars or gold. So that if there is a crash by the time it is needed it will actually be worth more Euros than it was before.

I am sure though that most schools have an accountant and/or lawyer who will have better ideas than myself.

Yes, I am aware that there has been pressure on the EU regarding the bail-in rule to make exceptions. However based on what the EU have said recently and how Merkel last week said they can’t keep changing the rules every two years I see this as unlikely, a lot of business and financial papers are of the same opinion too. Similarly, I know this is all speculation but I have tried to put in as many links as possible to explain how this is all very possible. What I would like to think is that everyone now will do their own research to understand this bigger picture and make the best decision for themselves. Moreover the question I really hope schools will now ask is: Is it worth the risk?

[I wrote a similar blog post about how for similar reasons I feel that the EU might fall apart and end due to this Euro Crisis, if anyone is interested. It explains some parts that I haven’t gone into too much detail within this letter]